Forget Stocks: Why the Bond Market Is the Real Threat to the Economy

All eyes are on the stock market right now. And why wouldn’t they be? Over the past two months, the S&P 500 has crashed 20% in one of the sharpest selloffs in modern history. We’ve seen some of the worst days ever recorded on Wall Street – and even one of the best, too.

Stocks are ricocheting back and forth like they’re trapped in a pinball machine. The Nasdaq swings 4% up one day, 5% down the next. It’s enough to make investors melt down.

But here’s the thing nobody seems to be talking about: The stock market isn’t the real risk right now. The bond market is.

And if we don’t get some relief there soon, we’re staring down the barrel of a potentially apocalyptic economic scenario…

For example, the 10-year U.S. Treasury yield is often called “the most important number in finance.” It’s not just a benchmark rate for Wall Street traders. It’s the foundation of nearly every major financing rate in America.

Mortgages, auto loans, student and personal loans, and credit cards are all tied to it.

Indeed, the entire U.S. consumer credit system leans on that number.

So, when the 10-year moves, everything does.

And over the first few weeks of April, the 10-year took off, spiking from 3.8% to 4.6% in just a few days – one of the most violent upward moves in modern market history.

That may sound abstract. But here’s what it really means:

- Mortgage rates will surge above 8%.

- Auto financing rates will punch past 9%.

- Personal loan interest rates will spike into the double digits.

- Credit card APRs will flirt with 30%.

All this in the middle of a slowing economy…

Why Surging Bond Yields Are a Huge Problem for the Economy

In every major recession, bond yields fall. That’s the natural cycle.

When things get bad, investors flock to safety. They buy U.S. Treasuries, which pushes yields down. Lower yields mean lower financing rates, which support consumer borrowing and help resuscitate demand.

For instance, during the 2008 financial crisis, the 10-year collapsed from 4.2% to 2%. And during 2020’s COVID Crash, it nosedived from 2% to 0.5%.

In both cases, the plunge in yields unlocked the economy’s natural shock absorbers – cheap mortgages, affordable car loans, and low-interest personal debt.

But this time, those shock absorbers are failing.

As we outlined in yesterday’s issue:

- Consumer confidence is near a 50-year low. According to the University of Michigan’s latest survey, consumer sentiment plunged 11% this month to 50.8 – a 12-year low and the second-lowest level on record since 1952.

- Retail sales are slowing, especially on a core basis. Though sales surged 1.4% in March, this uptick is likely temporary as consumers attempt to ‘frontload’ tariffs. In February, retail sales rose 0.2%, much lower than the 0.7% increase economists projected.

- Business investment has stalled, down $130 billion from Q3 to Q4 of 2024.

- The housing market is frozen solid. Data from the National Association of Realtors shows that existing home sales fell 1.2% year-over-year.

And now bond yields are spiking.

That’s not how this is supposed to go.

The Dangerous Divergence Between the Economy and the Bond Market

We’re watching the economy fall off a cliff – and borrowing costs are going up.

That’s a deadly combo.

As we mentioned, the housing market is already frozen. Affordability is stretched to historic levels. If mortgage rates rise from 7.5% to 9%, that market could break completely. And when housing goes, the economy tends to go with it. See: 2008.

Similarly, the auto market is already in a funk. And credit card debt is already at all-time highs. Higher rates will crush household finances, cut spending, and choke growth.

If bond yields keep spiking while the economy keeps slowing, we’re not talking about a mild recession.

We’re talking about a potentially historic economic meltdown.

So, why are bond yields spiking when they’re supposed to be falling?

There are two main reasons. And neither is natural.

1. Tariff-Driven Inflation Fears

Investors are terrified that the new tariff regime will reignite inflation.

If tariffs spike the cost of goods, inflation rises. And if inflation rises, investors demand higher yields on long-term debt to compensate. Nobody wants to hold a 10-year bond yielding 4% if inflation is running at 5%. That’s a guaranteed loss.

So, bondholders are panicking. And yields are surging.

2. Foreign Selling Pressure

The U.S. isn’t the only one upset about this trade war.

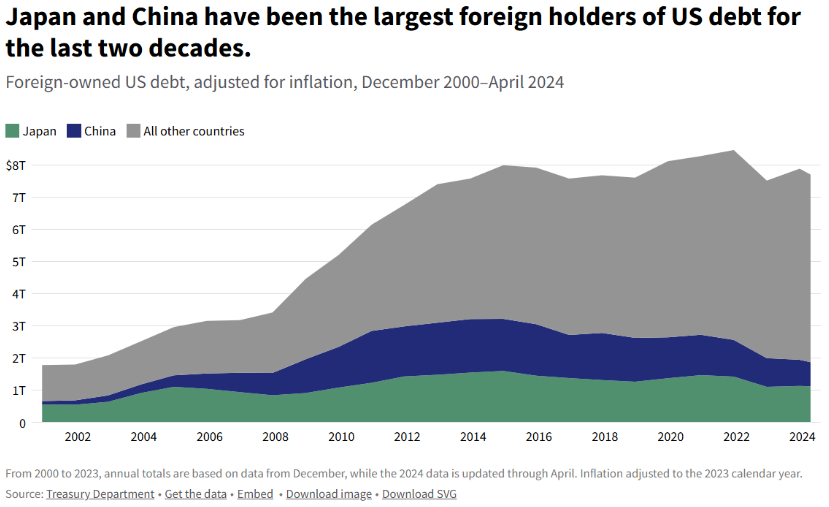

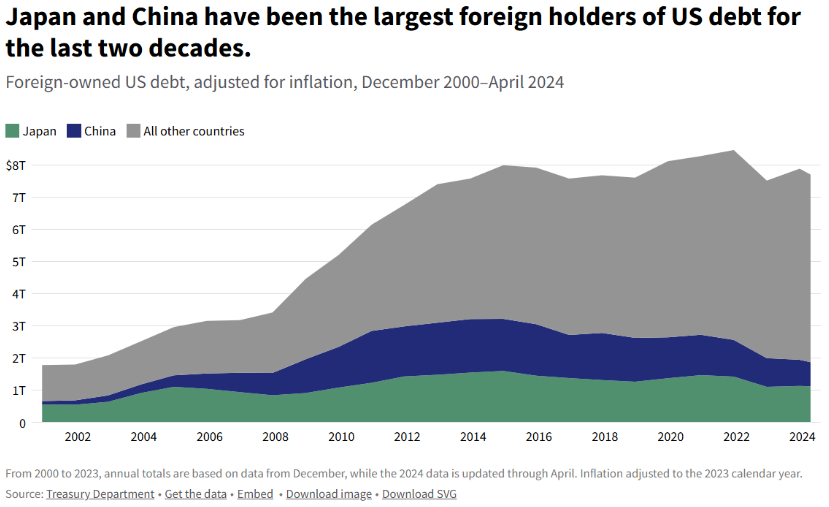

China and Japan – two of the largest foreign holders of U.S. Treasuries – may be quietly dumping U.S. debt in retaliation. After all, why hold the IOUs of a country you’re currently in an economic battle with?

This foreign selling creates additional pressure, pushing bond prices lower and yields higher.

Bond Market Relief Could Be Coming: Here’s Why

Now, here’s the good news: This pain is not driven by a permanent fixture. It’s the result of an acute political problem.

And political problems can be solved.

If trade tensions ease, inflation expectations will normalize, and foreign holders will stop selling Treasuries… and then, guess what?

Bond yields will fall.

And if bond yields fall, financing rates drop. The consumer endures. The housing market breathes. The economy stabilizes, and stocks recover: crisis averted. Therefore, we’re not panicking.

We understand the bond market risk. It’s huge – but it is also fixable.

That’s why we’ve been telling our subscribers to nibble on this stock market dip… because we believe resolution is coming.

We’ve already seen progress:

- A 90-day pause on new tariffs

- Electronics exemptions on Chinese exports

- Talk of an auto tariff exemption

- Softening Washington rhetoric

The signals are subtle, but they’re starting to stack up.

The White House knows what’s at stake. It may posture for headlines, but we think it’s also preparing for resolution.

Bond Market Turmoil: What It Means for Stocks, Housing, and the Economy

We are on the edge of something dangerous.

The bond market is ringing alarm bells. If yields don’t come back down soon, this trade war could destroy the foundation of the U.S. economy, starting with the housing market and then spreading like wildfire.

But we don’t think it will come to that.

The pressure is too intense. The pain is too real.

As such, we believe a trade war resolution is coming.

And when it does, the bond market will cool. Yields will fall. Financing rates will normalize. The recession risk will recede. And stocks will rebound.

If you’re looking to prepare for that market surge, consider buying AI 2.0 stocks on this recent dip.

We’re talking AI that can respond to real-world environments; embodied intelligence that can see, hear, walk, talk, lift, carry, organize, fix, learn…

After all, there’s a reason why every tech titan is suddenly obsessed with humanoid robots.

That’s where we believe the next trillion-dollar investment opportunities will be found. And we’ve found a compelling way to play that next phase of the AI Boom.

Uncover the details on our favorite AI 2.0 pick.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.